$11.6 Million Verdict Against Short-Term Rental Owner

Updated: September 7, 2023

Shock waves are reverberating through the short-term rental community after Fox 10 reported the verdict, handed down by an Alabama judge, for $11,600,370.84, against the owners of a short-term vacation rental property.

What Exactly Happened?

According to the complaint, an extremely inebriated short-term renter dove into a pool/lagoon which was 3 feet deep, broke his spine and is a quadriplegic. The plaintiff claimed the vacation rental owners knew the lagoon was shallow and unsafe for short-term rental guests and had failed to provide basic safety warnings.

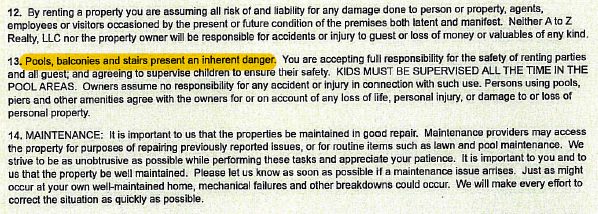

However, the public record shows item # 13 in the host’s rental agreement indicating a waiver of liability and language referencing “Owners assume no responsibility” with regards to the pools, balconies, and stairs.

How Could The Owner Have Avoided This Verdict?

Without seeing all the evidence, we can’t speculate, but one thing is for sure, a rental agreement alone is not enough. At Proper, we insure thousands of short-term vacation rental owners that offer pools, and our underwriting is strict when it comes to pool safety standards required for this very reason. Therefore, we require the following:

- Depth markers on all pools

- A swim-at-own-risk sign posted

- Life safety equipment in the pool area

- A waiver of liability in the rental agreement in regard to the use of the pool

It might be too late for these Alabama homeowners, but it isn’t for you.

Verify Your Short-Term Rental Insurance Today

While it’s important to ensure that your vacation rental has adequate safety features provided, it’s impossible to know what could happen, and that’s why it’s also important to have a policy to protect you and your business if an incident like the above were to happen at your rental. Proper Insurance leads the Nation in short-term rental insurance, with over 100,000 policies written in all 50 states. Backed by Lloyd’s of London and exclusive endorsements from short-term rental leaders such as Vrbo, Proper Insurance is built on world-class insurance coverage that meets and exceeds both city and lender requirements.