The Death of the Insurance Agent: Why Understanding Insurance is a Must for Short-Term Rental Investors

Written for BiggerPockets

The internet altered the world, and for the most part, it was a good thing. Most products and services got better, but not insurance — it got lost.

Before the internet, the insurance sector centered around an agent-driven business model in which insurance companies manufactured products and insurance agents sold them to consumers: home insurance, vehicle insurance, life insurance, and business insurance.

Insurance carriers learned that with the internet, they could sell straight to the consumer through the click of a button – eliminating the local agent’s need for a sales commission. Because of this shift, most insurance agents nowadays lack the knowledge and in-depth understanding of the coverage they provide in the complex 100-page contracts they sell. Resulting in the slow and agonizing demise of the professional insurance salesperson.

Although there are still thousands of traditional insurance agents in the United States, and many carriers still use the original concept, the modern-day insurance product for the consumer is generally poor. This is because the insurance industry shifted from a coverage-focused market to a price-based model.

That’s why standard insurance advertisements all say the same thing, “Switch and save.” No one has seen an advertisement from this industry that says, “Upgrade for better coverage.”

You should never build your insurance plan on price, especially for a short-term rental investment property, because you are compromising your coverage on a property that is highly at risk of something going wrong.

We all understand that self-education best serves the modern investor. So, let’s begin the journey of self-education on insurance for short-term rentals. After all, it’s your investment and your responsibility to protect it.

Verify Your Short-Term Rental Insurance

Start by knowing what kind of policy you currently have for your short-term rental property. There are only three insurance contract options to choose from when insuring a short-term rental investment property:

- Homeowners insurance (HO) contract

- Dwelling/Landlord insurance (DP) contract

- Commercial insurance (CP/CL) contract

The next thing you have to know when verifying your insurance is to outline what needs to be covered or what needs to be protected:

- The structure and contents inside of it. This is the physical asset and everything you, or your guests, can touch and feel. This includes the building structure, walls, furniture, electronics, etc.

- The revenue or income the asset generates. A short-term rental typically generates a much higher revenue stream for the modern investor than a long-term rental.

- The liability the asset brings with it. This includes the increased risk of bodily injury claims, like slip-and-falls) due to the high-traffic nature of short-term rental properties.

Homeowners Policy with a Home-Sharing Host Activities Endorsement (HO)

Here’s a common scenario – You seek insurance for your investment property that you want to list on Airbnb or Vrbo. The agent provides you with a Homeowners policy (HO) with an endorsement for Airbnb, also known legally as the Home-Sharing Host Activities Endorsement.

Now imagine that years later, a fire occurs at the rental property. However, the insurance carrier denies the claim because you aren’t residing there at the time of the fire, a requirement in Homeowners insurance policies under the definition of “residence premises,” aka the place you live and get your mail.

Legal cases, like American Risk Insurance Company, Inc. v. Veronika Serpikova, highlight similar disputes.

Serpikova’s claim was rejected as her Homeowners policy only covered her primary residence. Despite winning initially in the trial court, the appeals court overturned the decision. She received no claims payment because the insurance contract she signed was clear. This case emphasizes the importance of understanding your insurance coverage’s limitations.

If you own an investment property, one you do not live at, and you have it insured under a Homeowners policy, you have no insurance coverage. The insurance agent sold you the wrong policy, and you purchased it. It’s the insured’s responsibility to read and understand the contract.

Why was I offered a Homeowners policy if it does not cover my investment property?

It is simply a lack of training agents from large domestic insurance companies that are too big to fail. Large domestic insurance companies do not care about you, and insurance agents need more training. Need proof? Check out the Trustpilot review scores of Statefarm or Allstate.

What is the intent of the Home-Sharing Host Activities Amendatory Endorsement?

A Home-Sharing Host Activities Amendatory Endorsement is meant for a primary home (where you live and receive your mail) while being a host or occasionally short-term renting.

Hundreds of thousands of primary Homeowners rent a guest house, a bedroom, or even a tiny home in their backyard on Airbnb or Vrbo. A Homeowners policy with a home-sharing rider or endorsement is perfectly acceptable, and the intent of the form.

However, if this is the policy you have and the scenario in which you are using it, be aware that it’s very inexpensive and therefore provides minimal coverage. In that case, a commercial hybrid policy would be more suitable for someone regularly renting a primary residence as a short-term rental.

Dwelling/Landlord Insurance Contract (DP)

Short-term rentals have a high turnover, with each guest or rental group being entirely different. You willingly hand over the keys to your property and all its belongings to a different group of strangers each week rather than having one tenant for 12 months.

Structure and Contents

Dwelling/Landlord insurance provides no coverage if a group decides to let loose and party all week in your short-term rental and never has. The damage is considered intentional or malicious because you entrusted your property to this group of tenants/guests.

Where most insurance agents get confused, and can often mislead an investor, is the term “vandalism.”

Most comprehensive Dwelling/Landlord insurance contracts cover vandalism, such as the passerby throwing rocks at your windows or spray painting your siding. This differs from the tenants that you’ve invited inside your home by giving them the keys.

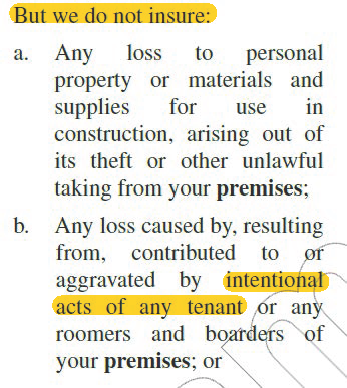

The average insurance agent sees that “vandalism” is named on the declarations page as coverage but fails to finish reading the length of the contract (as seen below), which clearly states, they do not insure any loss by intentional acts of any tenant.

Reference: Sample Dwelling/Landlord Policy (11003 03/06)

Revenue or Income the Asset Generates

Dwelling/Landlord insurance contracts provide “loss of rents,” calculated on “fair rental value,” typically capped at 12 months.

This is problematic for short-term rentals as rental income is typically much higher than a long-term or even mid-term property. At the time of the loss, the carrier will aggregate all surrounding rental properties and determine what’s average or fair based on your property characteristics, such as square footage and bedrooms.

With a short-term rental, the coverage you want is “lost business income” with actual loss sustained valuation and no time limit. This means you get reimbursed for what you actually earn, not what your surrounding neighbors average.

For example, in the event of a total loss, such as a fire, it’s typically 18-24 months before your investment property will be fully operational after a rebuild, so more than 12 months of protection is needed. Having no time limit is critical.

Liability of a Short-Term Rental

Short-term rentals are attractive to investors primarily for the nightly rental rates. But with a higher volume of guests comes much higher liability.

You are competing with Hilton and Marriott for travel lodging dollars, which means you are held to the same standard of care, which includes a legal obligation to deliver safe premises to your guests. This all falls under Common Law and, more specifically, Hospitality Law.

Dwelling/Landlord insurance contracts carry “Premise Liability,” which was never intended to cover the scope of a short-term rental business.

If a guest were to get injured off the premise and claim the short-term rental owner liable, there is no protection with a Dwelling/Landlord’s Premise Liability. An easy example of amenities off-premises is if your property offers guests bicycles, canoes, kayaks, etc.

Commercial Contract (CP/CL)

A short-term rental owner should not only carry a Commercial Property (CP) contract but also a Commercial Liability (CL) contract as well, which extends off the premises and provides bodily injury protection for the business operation.

The key in looking at Commercial Liability is reviewing exclusions, as most insurance carriers limit coverage.

Common liability exclusions to look out for and avoid when running a short-term rental business, if possible, are as follows: animal/pet or vicious dog breeds, communicable disease, liquor liability, invasion of privacy, punitive damages, amenities off-premises, assault and battery, nesting or infestation and personal and advertising injury.

Next Steps in Your Short-Term Rental Insurance Journey

Verify your insurance by calling an insurance agent you trust and asking the tough contract questions based on the scenarios outlined in this article. Remember that while an insurance agent can help you understand the contract to their best knowledge of the policy, it is ultimately your responsibility as the property owner to understand the contract you signed.

If you find that you are carrying a Dwelling/Landlord contract and are comfortable with the limitations of Premises Liability, here are some tips for filling the gap on guest-caused damage.

Five tips to minimize financial losses from tenant/guest-caused damage:

- Screening, screening, and more screening. There is a plethora of short-term rental screening companies that have emerged over the past decade, but property investors are in the business of getting more bookings, not overly screening guests, and denying bookings. The reality is you never know which group will cause significant damage.

- Find a short-term rental damage protection company that provides coverage for both accidental damage and intentional damage. Make sure to read the fine print here, as many providers have the same exclusion as a Dwelling/Landlord policy and only provide accidental damage coverage.

- Charge a significant security deposit, such as $5,000, and take the renter to civil court if damage exceeds it. This is how it’s been handled with long-term rentals for over 100 years.

- Make sure 100% of your bookings are processed through Airbnb, which provides AirCover for Hosts on every booking. But this takes away the option to book directly, which gets away from Airbnb’s high fees. It’s also unclear how responsive Airbnb is to tenant/guest-caused damage – it seems like a bit of a roll of the dice.

- Purchase a commercial insurance policy that provides a specific endorsement for no limit on damage caused by a tenant or guest. This is the single full-proof solution, but research shows there is only one provider of this in the U.S. and the policy comes at a premium.

In Summary

- Find an insurance agent you can trust and ask the tough insurance contract questions.

- Home-sharing insurance endorsements or riders only apply to primary homes, not short-term rental investment properties.

- Dwelling/Landlord insurance contracts suffice for short-term rental properties, but their low cost comes with big coverage gaps.

- Upgrade your insurance to a commercial insurance policy that provides coverage specific to a short-term rental investment property.