HOME SHARING INSURANCE

You need home sharing insurance if you rent your primary house on sites like Airbnb or Vrbo. However, a home sharing insurance endorsement does not cover investment, or secondary vacation rental properties, despite what some people may believe.

Many homeowners insurance carriers offer a homeshare endorsement, which only applies to a primary residence or dwelling.

There is a significant difference between vacation rental or short-term rental insurance and home-sharing insurance, but Proper Insurance is the U.S. market leader in both.

Understanding Home Sharing Insurance

You need home sharing insurance when you short-term rent or share your primary home with a guest to protect yourself against possible property damage, responsibility for bodily injury, and lost rental revenue.

A homeowner’s policy can be amended to include a home-sharing endorsement to give coverage. However, the coverage is often quite restricted and typically covers up to $10,000 in theft and personal property damage.

A limited home-sharing endorsement was inadequate for short-term rental properties, so Proper adopted a different strategy and created the most comprehensive home-sharing insurance coverage for hosts.

Whether the property is being used as a personal residence, rented out on a short-term basis, or shared with others, our insurance offers complete limits for the building(s), contents, liability, and lost rental income.

PRO TIP: If your short-term rental property is a second home or an investment property, a homeshare insurance endorsement is inappropriate and irrelevant. You require coverage for commercial short-term rentals.

Insurance Agents Are Misusing The Home Sharing Endorsement

Insurance is simply a contract between the insurer and policyholder – which is why you must read this if you are considering a home-sharing insurance endorsement.

If your short-term rental property is NOT your “residence premises,” often known as your “primary home,” insuring it under a homeowner’s policy that includes a home-sharing endorsement is incorrect, and your policy may be null and void.

Let’s explain: A homeowner’s policy is not intended for secondary dwelling short-term rental properties. The home-sharing insurance endorsement was created for permanently or continuously owner-occupied properties.

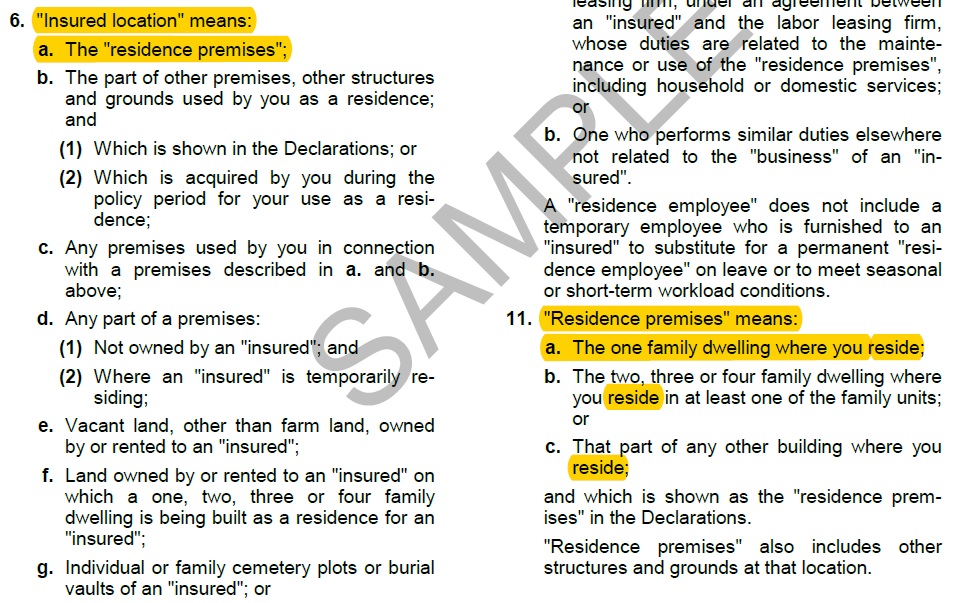

The two most crucial definitions of “insured” and “insured location” are found in all written homeowner’s insurance contracts and serve to frame the contract. Your policy first refers to the “insured location” as the “residence premises” and then refers to the home where you reside as the “residence premises.”

This is crucial, as homeowner’s insurance forms do not define “reside,” so when claims are denied, they let the courts decide. Virtually all courts follow the standard law definition below:

Reside = to dwell permanently or continuously; occupy a place as one’s legal domicile

How Courts Interpret “Residence Premises”

Fundamentally, the property and liability exposure of residential properties where one resides is entirely different than an investment or rental property. Insurance companies are often seen as the bad guys, but in reality, it’s the insureds who are legally required to read and understand the insurance contract they purchased.

The best clear-cut example of how important the “residence premises” definition is Veronika Serpikova Vs. American Risk Insurance Company.

She was insured on a homeowner’s insurance policy, yet the property had become a rental, so not her residence premises at the time of the loss. Her claim for fire damage was denied and upheld by the appeals court, ruling in favor of the insurance carrier.

If your Airbnb or Vrbo property is NOT your primary residence, do NOT buy a home-sharing insurance endorsement.

Home Sharing Coverage from Proper Insurance

Proper Insurance has seen and insured just about every homesharing scenario possible. Think of a primary residence that short-term rents the guest house or a residence that put a tiny house in the backyard and advertises it on Airbnb or Vrbo.

The key is that the owner of the property considers the property their primary residence, meaning it’s the address they get their mail or where they reside the majority of the year.

Proper Home Sharing Insurance Highlights

Designed to entirely replace a homeowner’s or landlord/dwelling insurance policy. Because our policy covers the building(s), contents, liability, and business income, there is no reason to maintain multiple home insurance policies.

Home Sharing Liability Insurance

When you host a guest for less than 30 days and receive payment to do so, this is considered a business transaction, and insurance contracts begin to break down, especially liability insurance.

If a guest is injured while staying at your property, such as falling down the stairs or getting bit by a dog in the neighborhood, they often claim the host liable and sue. This is where you need commercial business liability insurance.

But then, since it’s your primary residence, you may host a personal cocktail party with your friends, and the same incident occurs, except this time, you would need personal liability insurance as it does not involve a business transaction.

Having both commercial and personal liability is the foundation of Proper’s homeshare insurance coverage.

Home Sharing Insurance FAQs

What is home sharing insurance?

Home sharing insurance protects hosts who let visitors stay in their principal residence or a portion of it on a temporary basis for fewer than 30 days at a time. The host of the home sharing often uses Airbnb or Vrbo to promote their property and charges a per-night occupancy fee.

What are the risks of home sharing?

Home sharing involves two main risks. The first risk is potential damage to the host’s property; the second risk is potential bodily harm to a guest and the ensuing possibility of legal action holding the host accountable. Home sharing hosts must be aware of their risks and understand them, and obtain the necessary insurance.

Does my homeowner’s insurance cover home sharing?

No, a typical homeowner’s insurance policy does not cover business activities or exposures, and renting a property for a nightly rate for fewer than 30 days is seen as a business transaction. There are home sharing endorsements a host can add to an existing homeowner’s policy. Still, they are constrained and far from comprehensive, exposing the host to property and liability insurance gaps.

How much does comprehensive home sharing insurance cost?

Complete home sharing insurance protection, which would include replacement cost coverage for the building(s) and contents, business revenue coverage, in addition to both personal and business liability, would often increase a host’s premium by 30 to 50%.

How much money can a home sharing host make?

Everything depends on the occupancy rates and the home sharing area or market. Many home sharing service hosts who earn well over $50,000 annually are covered by Proper.